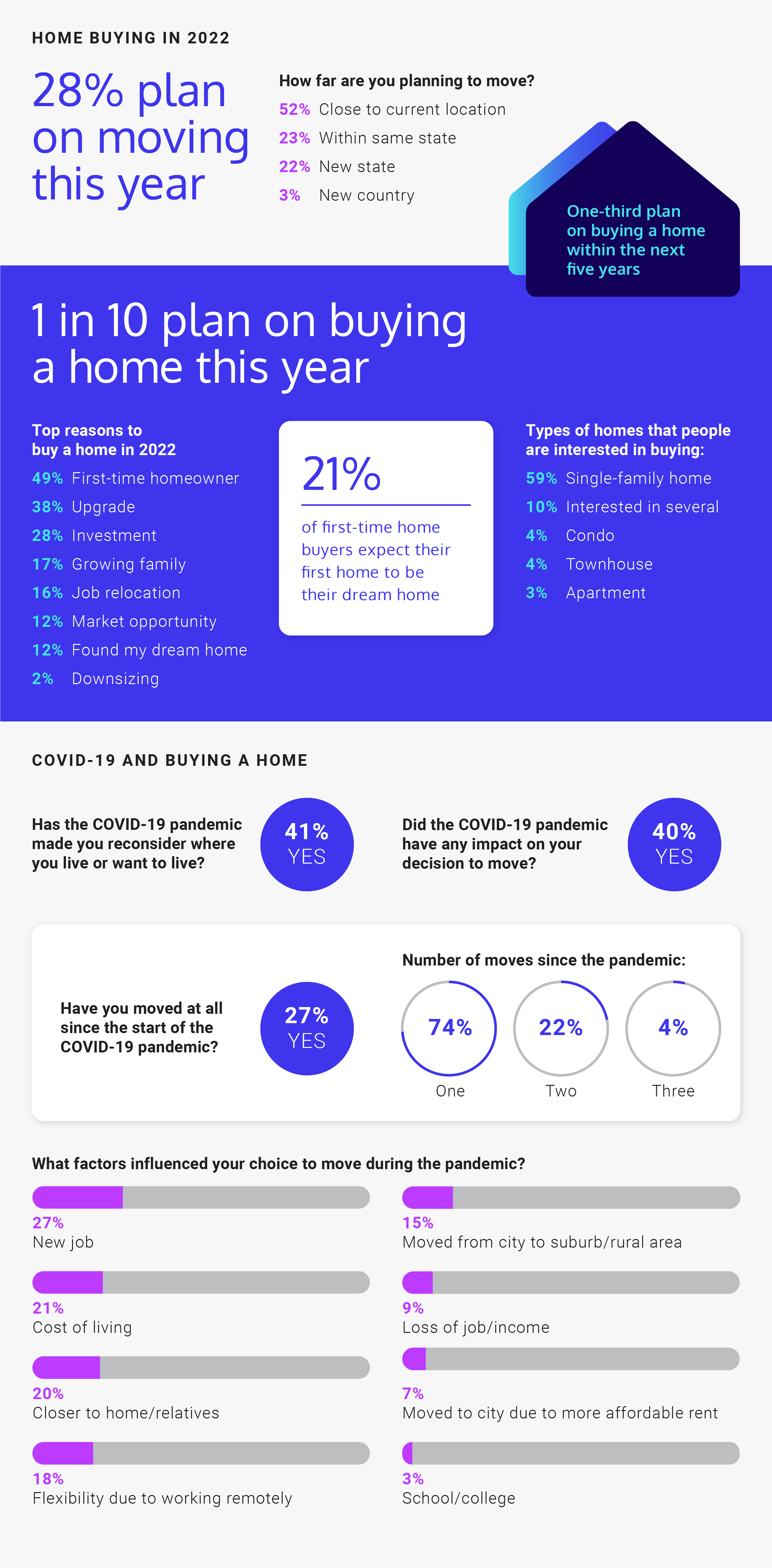

What might the housing market look like in 2022? Mortgage Cadence, a digital mortgage lending company, surveyed over 1,000 Americans to better understand this year’s opinions.

For many people, 2021 was the year to buy a home. Whether it was first-time home buyers, or people finally finding their dream homes, chances are someone you know was involved in buying or selling a home.

But with the new year comes a new housing market, and a survey of over 1,100 Americans across the country reveals what this year may look like from a homeowner’s or home buyer’s perspective.

According to respondents, about 3 in 5 people are planning to move this year. More than half of those moving plan to stay pretty close to their current location. But about a quarter (22%) are planning on moving to a new state, and some (3%) are even planning an international move.

How many of those moving are planning to buy a home? Among the survey respondents, 1 in 10. People are planning to buy a home this year for various reasons, include job relocation, a growing family, upgrading, downsizing or a first-time purchase.

The COVID-19 pandemic has had a huge influence on all of our lives, and that includes the housing market. The survey found that 41% of participants have reconsider where they live or where they want to live due to the pandemic, and over one-quarter (27%) have already moved at least once since the start of the pandemic.

Why might people have moved in the last couple of years during a global pandemic? People said that remote work allowed them to live where they wanted, they got a new job, they wanted to move closer to relatives, or they wanted to move out of the city and into the suburbs.

As more people look toward buying a new home or even their first home, rising market costs are a concern. In fact, nearly 4 in 5 people think that homes will be less affordable in 2022: 4 in 5 are also concerned about rising home prices and 72% say they’re concerned about an increase in interest rates. If interest rates do continue to rise, 26% add that they’ll be less likely to buy a home this year.

When asked about budgets, the majority of respondents say they’re looking at homes in the range of $150,000 to $249,999. And when it comes to a down payment, the average amount of savings that people have is about $52,500. Can people even afford to buy a home this year? According to 64% of respondents, that answer is no.

Before you even buy a house and consider moving, you have to actually find somewhere you want to live. Back in the day, you could drive around neighborhoods where you wanted to live and see if there were any “For Sale” signs popping up. Now, thanks to the internet and social media, looking at homes for sale has become a pastime.

More than half (58%) of our respondents say they still spend time looking at what’s for sale, even if they’re not actively searching for a new home. For some, this is a daily activity; for others, monthly. It may come as no surprise, but Zillow is the most popular way people look at homes for sale.

More than half (58%) of our respondents say they still spend time looking at what’s for sale, even if they’re not actively searching for a new home. For some, this is a daily activity; for others, monthly. It may come as no surprise, but Zillow is the most popular way people look at homes for sale.

But even if they find their dream home, there’s no guarantee it’ll still be available by the time homebuyers can put in an offer. Among those surveyed, 4 in 5 believe the current housing market is too competitive and that the current demand for houses would impact their decision to buy.

Owning a house, especially for the first time, may also be overwhelming, and 4 in 10 say that even the prospect of owning a home overwhelms them. Some of the most potential overwhelming factors include a high monthly mortgage, the cost of upkeep, the home’s location and rising crime rates.

When it comes to looking and finding a home, everyone has different priorities. Some people (39%) say it’s more important how they feel about the home, while the majority (61%) say it’s all about the home’s features.

The most important feature, according to respondents, is the property location (88%). Other important features include the size of the home (73%), its price (68%), the number of beds and baths (64%), and the year it was built (33%). Additionally,15% reported a home’s DIY potential as one of the most important factors when looking for a home. Some people may be interested in flipping a house and truly making it what they want to be.

More than 4 in 10 say they’re interested in buying a home and then doing home renovations, either DIY or for hire. Unfortunately, 19% say that the recent supply chain issue is affecting those home projects.

Methodology: Mortgage Cadence surveyed 1,105 Americans in January 2022 to get their feedback on homeownership and what this year will bring in terms of a homeowner’s outlook. Respondents were 48% female and 49% male, with an age range of 18 to 79 and an average age of 37 years old.

This article first appeared at Mortgage Cadence.

Comments